Your credit score is a numerical representation of your trustworthiness in paying back debt. Each bureau will present you with a credit score based on the data they have.

What is your credit score?

Your credit score is a numerical representation of your trustworthiness in paying back debt. Each bureau will present you with a credit score based on the data they have.

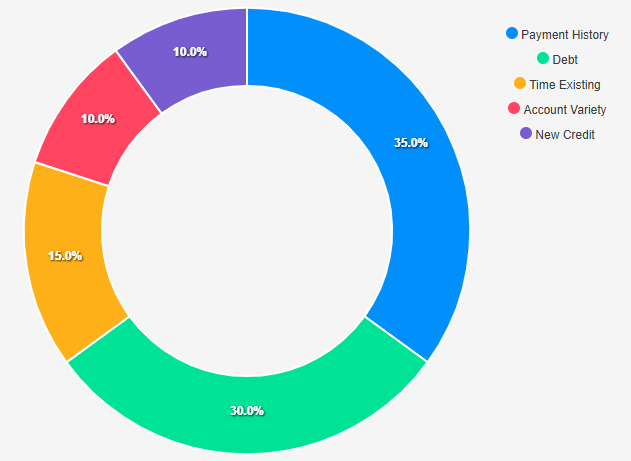

Credit history is a record of the “health” of each reporting credit line. Your credit score is created from the list below. Account Variety means having a diverse set of account types, installment, mortgage, revolving, etc… New Credit can show up from employment screening, utility providers, insurance related inquires, and other credit inquiries.

Credit Cards

Installment Loans

Credit issues will not haunt you forever when you actively try to improve your credit. Lenders know that “life circumstances” happen such as illness, divorce, loss of job or accidents. The key is to show the lender that prior to the life circumstance you showed responsible use of credit and that after the life circumstance you re-established your credit. As you add new information to your report the old information ages. Scores will change gradually, as you change the way you handle credit.

Remember the older the trade line (credit), the less impact it has on your scores.

Fixing credit reporting issues , such as incorrect collections showing up, late payments showing up when paid on time, active accounts that are closed, can be fixed. The key is to identify any issues and work toward having them corrected. If you want to take action, the first step would be to call the bureaus at: